A million, a million and a half, two million, unfortunately, that doesn't even sound like a lot of money now days when we hear words like billions and trillions thrown around so easily. So let me bring it down to numbers that we can all feel and understand.

A million and a half dollar increase to the operating budget of the school system would require around a 15 cent property tax increase. Two million would require about a 20 cent increase. Just three or four years ago, tax payers were hit for a 16 cent property tax increase to pay for the schools building program.

I have no idea if a majority of the county commissions are prepared to hit property owners with a big tax increase or not but obviously, members of the school board budget committee are all for it.

Here's my request to the school board members. Stop using the million dollar numbers and start telling folks how much property tax increase they are asking for. Stand right up and tell the voters, I board member_________________ want to raise your property taxes by_____ beginning next year in order to give ___% raises.

Next year, over half the school board members will be up for re-election. Maybe they could start their re-election campaigns now with a campaign platform of higher taxes for all.

Below is a little information on teacher pay in Loudon County

Current Loudon County per capita income is $39,800.00.

Average Loudon County full time teacher pay (200 day contract)

$45,445.00. Highest, $58,819.00 lowest 35,202.00.

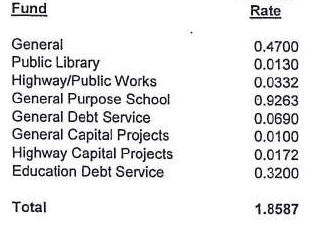

Current property tax rate, $1.86. School Board receives nearly $1.25 or

67% of of all property taxes collected.

Current tax rate and distribution by department.