Rain Tax Review

| In 1972, the EPA passed certain clean water

regulations on the states . In 1977, Tennessee passed certain clean

water regulations required by the EPA on some cities in the state based

on populations. In 1993, Tennessee passed a law that allows, but does

not require, certain cities to pass a rain tax to fund stormwater

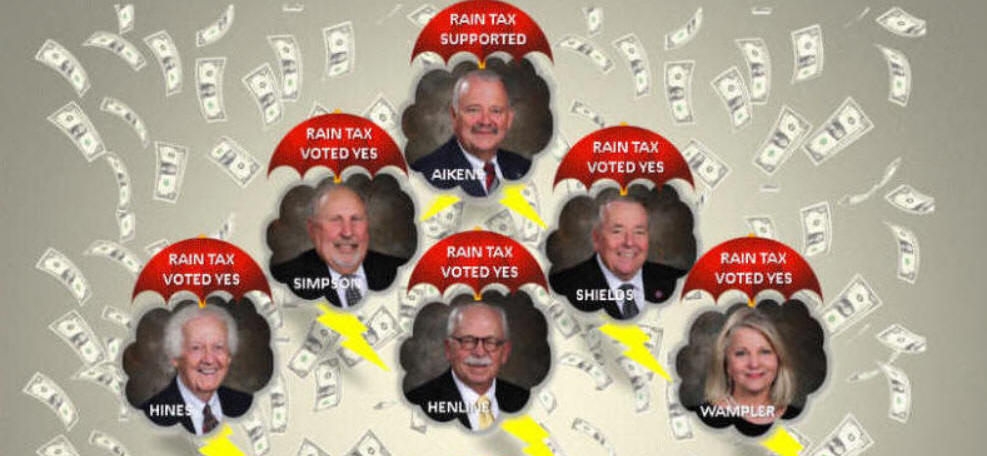

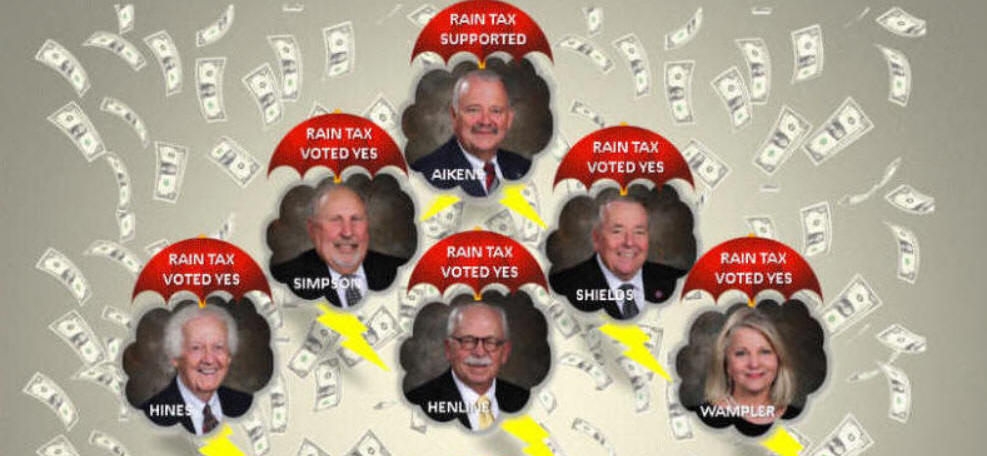

and flood control systems. And be assured, the Rain Tax IS NOT mandated by any federal or state agency and if anyone says it is, they're either very misinformed and just plain lying. This law is very specific and clear on how any Rain Taxes can be used. These moneys can only be used 100% for stormwater and flood control and cities can not charge any more than is required to fund the construction, operations and maintenance of said stormwater and flood control systems. Obviously, Tennessee legislators of 1993 never realized that politicians of 2017 would so corrupt and misuse that law as to turn it around and not only, not, do anything for stormwater and flood control but use it as an underhanded, backdoor way to raise taxes and squeeze more money from their citizens. That's exactly what the Lenoir City council did with the passage of the Rain Tax. Here are the things the city is required to do. All are essentially administrative and would add very little expense to the city's budget. But the city passed the Rain Tax and have now squeezed nearly a half million dollars from property owners in the city.

• Conduct public education and outreach to inform

residents about the impact polluted stormwater runoff can have on

water quality.

• Provide opportunities for residents to participate

in program development and implementation, including effectively

publicizing public hearings and/or encourage resident representation

on a management panel.

• Develop and implement a plan to detect and

eliminate illicit discharges to the storm sewer system.

• Develop, implement and enforce an erosion and

sediment control program for construction activities that disturb

one or more acres.

• Develop, implement and enforce a program to address

discharges of post-construction stormwater runoff from new

development and redevelopment areas.

• Develop and implement a program with the goal of

preventing or reducing pollutant runoff from municipal operations,

which must include municipal staff training on pollution prevention

measures and techniques.

Given that Lenoir City officials have no current or future plans for any extensive stormwater and flood control repairs or construction, they could not have legally justified any substantial Rain Tax on city residents, businesses, churches and schools. Again the law says every penny of any Rain tax must go to stormwater and flood control. So somebody in the city system came up with the bright idea, we'll just move a bunch of existing employees, mostly from the street department, into the Rain Tax budget to justify how high the Rain Tax will be and that would free up all that money in existing budgets that can be used in any way they want to use it. This is not how the law was intended to be used. I think the Lenoir City Administrator, Amber Scott, sort of let the cat out of the bag in an interview with the News Herald. She said,

So according to Ms. Scott, the Rain Tax was actually passed to fund other departments but it had to be kind of a money laundering operation to do that. Any elected official who raises taxes on their constituents unnecessarily should be voted out of office at the earliest possible opportunity. But any elected official from governor to city councils who would unnecessarily raise taxes on their constituents and use misinformation, disinformation or down right dishonesty to achieve such an underhanded tax increase should resign immediately. Obviously, they have lost their ability to represent the people. |

BACK

10/8/18