So according to some Tellico Village POA members, they're just no way they could ever incorporate into an independent city? Just too political difficult. Is that right?

But they sure don't have any problems getting new state laws written to allow them to operate as a city but without having to operate as a city.

Just last month, state legislators passed a special law that allows the POA to take big tax breaks just as if they were a city, but the POA and it's director stay in place.

Just a year ago, state legislators passed a controversial state law that allows the Tellico Village to have liquor stores, just like a real city but the POA and it's director stay in place.

You folks in Tellico Village are being hosed and either don't know it or don't care. Either way, the cost of living in the village is just going to get higher and higher.

It's time to incorporate, it's time for the residents who live in the village to chose who represents them.

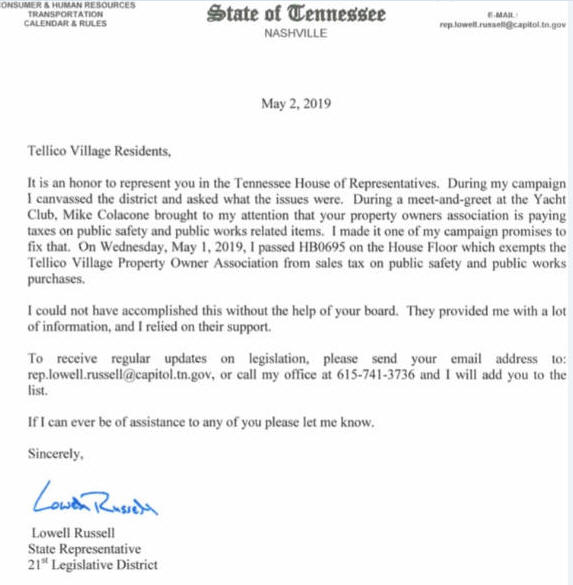

Below is the bill summery of the newest law and a letter from State Representative Lowell Russell.

Bill Summary

HB0695-This bill exempts from state sales and use tax the sale of public safety and public works-related goods to a nonprofit property owners association that has received a 501(c)(4) exemption from the IRS and maintains more than 100 miles of roads.

The exemption will only apply to sales made directly to the exempt association. There will be no exemption for sales made to an independent contractor with any such exempt association. This bill prohibits the dealer from selling, and an association from using, any tangible personal property under the claim that the property is exempt from the sales or use tax without an exemption certificate from the commissioner of revenue declaring that such association is exempt pursuant to this bill. An association that has obtained an exemption certificate must provide a dealer with a copy of the certificate and the dealer must maintain a copy of such exemption.

If a property owners association uses its exemption authorization to purchase other goods not exempted, the association will be liable for any applicable tax, penalty, and interest.

ON APRIL 30, 2019, THE SENATE ADOPTED AMENDMENT #1 AND PASSED SENATE BILL 1455, AS AMENDED.

AMENDMENT #1 limits the amount of the sales and use tax exemption created by this bill to $25,000 per year and defines "public safety or public works-related goods" to which the exemption will apply to mean equipment and supplies used:

(1) In the construction or maintenance of utilities, roads, culverts, curbs, sidewalks, parks, landscaping, docks and dock facilities, sewage and wastewater systems, and flood control and drainage systems, including storm water sewers and drains; and

(2) For firefighting, security, and emergency medical services, including fire alarm and emergency alert systems.