Back in September, Sheriff Tim Guider announced Loudon County Jail Administrator Teresa Smith has resigned from her post following a state investigation involving the missing inmate funds. According to Guider, the investigation has been turned over to the TBI and the District Attorney's office.

Keep in mind, the missing funds reported below were just for the previous year. There is no information whether funds from past years were missing.

Below is the full text of the audit report.

ANNUAL FINANCIAL REPORT

LOUDON COUNTY, TENNESSEE

FOR THE YEAR ENDED JUNE 30, 2014

COMPTROLLER OF THE TREASURY

JUSTIN P. WILSON

DIVISION OF LOCAL GOVERNMENT AUDIT

JAMES R. ARNETTE

Director

PART II, FINDINGS RELATING TO THE FINANCIAL STATEMENTS

Findings and recommendations, as a result of our examination, are presented below. We reviewed these findings and recommendations with management to provide an opportunity for their response. The written response of the sheriff is paraphrased in this report. Other management officials did not provide responses for inclusion in this report.

OFFICE OF SHERIFF

FINDING 2014-001

A CASH SHORTAGE OF AT LEAST $13,976.84 EXISTED IN THE SHERIFF’S OFFICE(Material Noncompliance Under Government Auditing Standards)

A cash shortage of at least $13,976.84 existed in the Sheriff’s Office. This cash shortage represents inmate commissary collections not properly deposited into the commissary bank account. Funds totaling $6,649.84 were recovered from the trunk of a county-owned car and reduced the outstanding cash shortage to $7,327 as of August 25, 2014. Internal control deficiencies over inmate commissary funds allowed this cash shortage to occur and remain undetected. The following table summarizes the shortage:

Amount Collections Not Deposited Into the Commissary Bank Account$13,976.84 Less: Amounts Recovered(6,649.84) Outstanding Cash Shortage as of August 25, 2014 $7,327.00

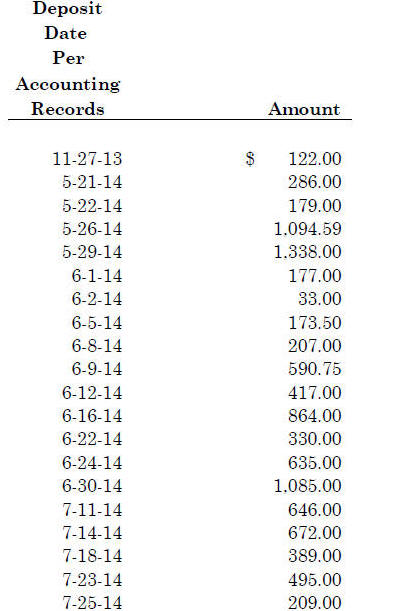

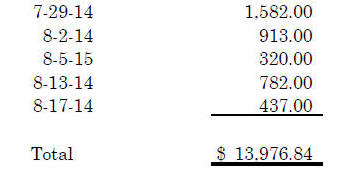

During our annual audit of the Office of Sheriff for the year ended June 30, 2014, we discovered discrepancies related to collections and bank deposits related to inmate commissary funds. While examining the inmate commissary bank reconciliation for the month of June 2014, we noted several outstanding deposits from May and June 2014, and one deposit that had been outstanding since November 2013. We also noted an unusual delay between the dates that other bank deposits were reflected in the office’s accounting system and the date that those deposits were actually deposited to the bank. Due to these discrepancies, we extended our procedures to include inmate commissary transactions for the period July 1, 2013, through August 25, 2014. After comparing commissary receipts with bank deposits, we discovered that collections totaling $13,976.84 had not been deposited to the commissary bank account and were not on hand in the Sheriff’s Office. The following table summarizes the missing collections and reflects the date the office’s accounting system indicated that these funds were deposited. However, these funds were not deposited to the bank account.

On August 25, 2014, we interviewed the employee responsible for picking up the deposits for the inmate commissary bank account and carrying the deposits to the bank. She indicated that she had some of the missing collections in the trunk of her county-owned car. Auditors and officers of the Loudon County Sheriff’s Department accompanied the employee to her car, and she presented several envelopes containing funds that had been prepared for deposit into the inmate commissary account. Most of these deposit envelopes had been sealed, but then reopened. Comparison of the amount of funds found inside the envelopes with the corresponding deposit slips and the totals written on the outside of each envelope indicated that some funds had been removed from the envelopes. Funds recovered from these envelopes totaled $6,649.84. These recovered funds were deposited into the inmate commissary account on August 25, 2014, which reduced the total of funds missing from the inmate commissary account to $7,327. The employee was placed on administrative leave without pay on August 25, 2014, and she resigned on August 26, 2014.

This finding has been discussed with the district attorney general.

RECOMMENDATION

County officials should take steps to recover the remaining cash shortage.

___________________________________

FINDING 2014-002

DEFICIENCIES WERE NOTED IN CONTROLS OVER INMATE COMMISSARY OPERATIONS(Internal Control – Material Weakness Under

Government Auditing Standards)For much of the period between July 1, 2013, through August 25, 2014, duties related to the inmate commissary funds were somewhat segregated between the employee mentioned in the above finding and another employee. Both employees receipted inmate commissary funds into the office’s accounting system and prepared those funds for deposit. The employee mentioned in the above finding was responsible for carrying the deposits to the bank, while the other employee was responsible for reconciling the bank statements at month-end. The employee reconciling the bank statements at month-end did not question why deposits were not reaching the bank in a timely manner after they were recorded in the accounting system. Subsequent to June 30, 2014, and prior to our audit, this employee was assigned to other duties, and all duties related to the commissary became the responsibility of the employee mentioned in the above finding, resulting in inadequate segregation of duties. The failure to investigate outstanding deposits on the bank reconciliations, followed by inadequate segregation of duties subsequent to year-end, as well as a lack of supervisory oversight of commissary operations for the entire period examined allowed the shortage reported in Finding 2014-001 to remain undetected until auditors arrived in late August 2014.

RECOMMENDATION

Bank statements should be reconciled with accounting records by personnel with adequate knowledge of the reconciliation process, and any differences should be investigated promptly. Duties should be segregated adequately among employees. Inmate commissary operations should have adequate supervisory review. All funds should be deposited currently

.FINDING 2014-003

DUTIES WERE NOT SEGREGATED ADEQUATELY(Internal Control – Significant Deficiency Under

Government Auditing Standards)Duties were not segregated adequately among the official and employees in the Office of Sheriff. Employees responsible for maintaining accounting records were also involved in receipting, depositing, and/or disbursing funds. Accounting standards provide that internal controls be designed to provide reasonable assurance of the reliability in financial reporting and of the effectiveness and efficiency of operations. This lack of segregation of duties is the result of management decisions based on the availability of financial resources and is a significant deficiency in internal controls that increases the risk of unauthorized transactions.

RECOMMENDATION

The sheriff should segregate duties to the extent possible using available resources.

MANAGEMENT’S RESPONSE – SHERIFF

We have addressed the issue of the shortage of funds from the commissary account with the district attorney general and requested the TBI to investigate. This is an ongoing investigation at this time.

Regarding the segregation of duties, we are aware of this being an ongoing problem due to lack of personnel. We will continue to do our best to comply.